Market Snapshot for Miami Multifamily Real Estate

We’ve compiled key statistics (vacancy rates, absorption rates, and rental rates) and property transactions for Miami multifamily real estate in this report. The Miami multifamily report is updated quarterly by our commercial real estate professionals. We also want to cover the bigger picture and provide some information about the health of the economy overall in Miami / South Florida, as that is the engine that drives the business taking place in the region.

Florida is one of the top states for population growth in the United States, and recently has experienced a population boom. Some estimate that nearly 1,000 people move to the state every day! There are a few important factors that contribute to this: 1) it’s very tax-friendly (no income tax), 2) many people from other states (New York, for example) move to Florida to retire, and 3) it has a great reputation for having desirable weather year-round. This may be the reason for its nickname, The Sunshine State.

View our commercial properties in Florida to see what real estate assets are available for lease / sale.

Before we dive into the specific statistics for Miami’s multifamily real estate market in Q2 2023, let’s give some perspective with the overall capital markets figures to give some context to the region’s multifamily sector.

Miami Multifamily Capital Markets Statistics Q3 2023

Total Asset Value: $66.5B

12-Month Sales Volume: $1.9B

Average Market Cap Rate: 5.0%

12-Month Market Sale Price Change / SF: -6.0%

Miami Multifamily Real Estate Sales Volume by Buyer Type & Origin (Past 12 Months)

Below are the buyer types and their origins, i.e.: local, national, or international investors of multifamily assets in Miami.

Buyer Type:

Private: 67%

User: 1%

Institutional: 15%

Private Equity: 4%

REIT / Public: 13%

Buyer Origin:

Local: 22%

National: 77%

Foreign: >1%

Miami Multifamily Real Estate Asset Value by Owner Type & Origin (Past 12 Months)

Below are the owner types and the origins of multifamily property owners in Miami broken down by their percentage of representation.

Owner Type:

Private: 64%

User: 13%

REIT / Public: 7%

Institutional: 12%

Private Equity: 4%

Owner Origin:

Local: 55%

National: 42%

Foreign: 3%

Miami Multifamily Real Estate Statistics: Leases, Sales, and Projects Under Construction – Q3 2023

Here’s a summary of the statistical highlights, latest multifamily property transactions, vacancy / lease trends, and current market activity for South Florida, with a focus on Miami. The analysis below is derived and compiled from leasing stats, latest transactions, and projects under construction in order to further understand the overall state of the multifamily market in Miami.

Full List of Top Transactions for Q3 2023 Provided Below

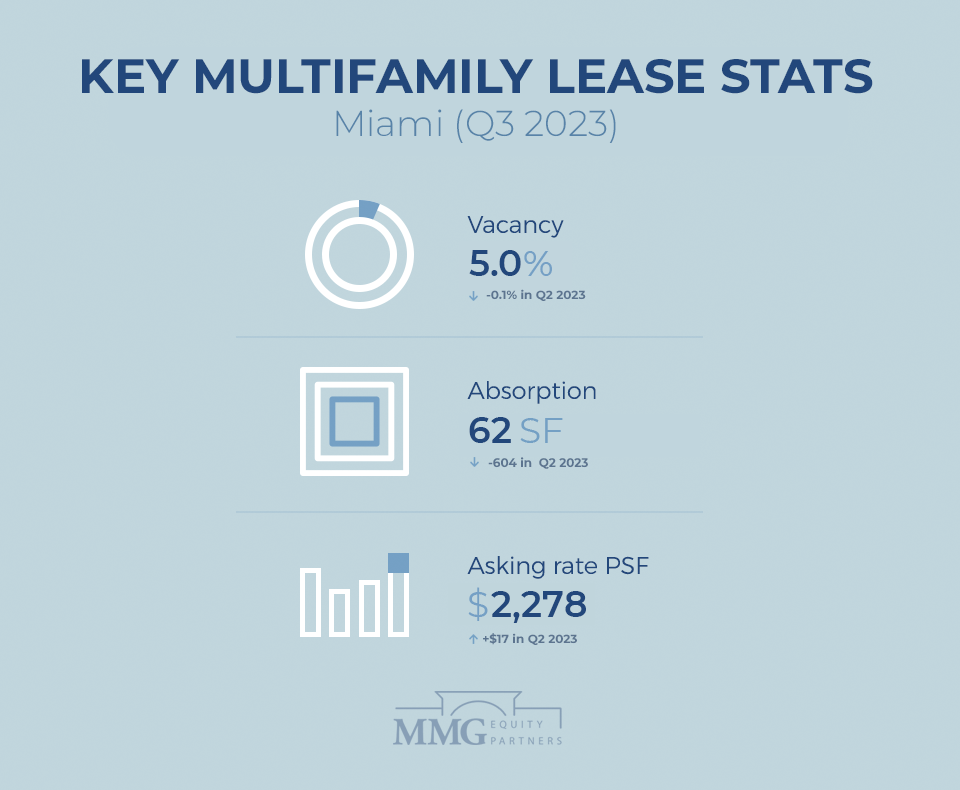

KEY MULTIFAMILY LEASE STATS: Miami (Q3 2023)

- Vacancy: 5.0% (-0.1% compared to Q2 2023 at 5.1%)

- Absorption (Units): 62 (-604 compared to Q2 2023 at 666)

- Average Asking Rent / Unit: $2,278 (+$17 compared to Q2 2023 at $2,261)

TOP MULTIFAMILY LEASING STATISTICS: Miami (Past 12 Months)

12 Month Deliveries (Units): 6,362

12 Month Net Absorption (Units): 5,487

Vancancy Rate: 5.0%

12 Month Rental Growth: 1.2%

TOP MULTIFAMILY SALES STATISTICS: Miami (Past 12 Months)

Over the course of the past 12 months there have been 256 total multifamily property transactions in Miami with an average vacancy at sale of a little over 12% for the properties. The average price per unit at the time of sale was $286K, and the average sale per property was $8.3M.

Sales Comparables: 256

Average Price / Unit: $286,000

Average Price/ Property: $8.3M

Average Vacancy at Sale: 12.2%

TOP MULTIFAMILY SALES TRANSACTIONS: Miami (Q3 2023)

Top Transaction Highlight in 2023: Southgate Towers Apartments for $271M

1. Southgate Towers Apartments (900 West Ave)

Price: $271,058,000

Units: 495

Price/ Unit: $547,591

Year Built: 1958

Vacancy: 2.6%

2. The Boulevard (5700 Biscayne Blvd)

Price: $175,000,000

Units: 282

Price/ Unit: $620,567

Year Built: 2022

Vacancy: 56.4%

3. Park 82nd Apartments (8255 Park Blvd)

Price: $156,000,000

Units: 356

Price/ Unit: $438,202

Year Built: 2022

Vacancy: 8.7%

4. CORE (3060 SW 37th Ave)

Price: $127,000,000

Units: 312

Price/ Unit: $407.051

Year Built: 2021

Vacancy: 9.0%

5. Oak Enclave (2301 NW 167th St)

Price: $113,000,000

Units: 420

Price/ Unit: $269,047

Year Built: 2022

Vacancy: 30.7%

MULTIFAMILY PROPERTY CONSTRUCTION PROJECT STATISTICS: Miami (Past 12 Months)

There are currently 95 multifamily assets / properties under construction in the Miami market representing over 30,000 new units into the market. This represents 17.4% of the total multifamily real estate inventory. The average number of units in these 95 properties is 339.

Below the stats you’ll find the top-5 largest multifamily assets currently under development.

Properties Currently Under Construction: 95

Units: 32,250

Percent of Inventory: 17.4%

Average Number of Units: 339

MULTIFAMILY CONSTRUCTION PROJECTS: Miami (Past 12 Months)

1. Mana-Wynwood Residents

Units: 3,487

Stories: 10

Completion Date: Q3 2024

Developer/ Owner: Moishe Mana / GRM

2. The River District Apartments – 401 SW 3rd Ave

Units: 1,600

Stories: 54

Completion Date: Q4 2024

Developer/ Owner: The Chetrit Group / The Chetrit Group

3. CentroCity – 3825 NW 7th St

Units: 1,200

Stories: 8

Completion Date: Q3 2024

Developer/ Owner: Terra Group / Not Listed

4. 1 Southside Park – Apartments – 1105 – 1133 SW 2nd Ave

Units: 1,175

Stories: 64

Completion Date: Q4 2023

Developer/ Owner: JDS Development Group / JDS Development Group

5. Emerald Bay – 4030 W 88th St

Units: 917

Stories: 5

Completion Date: Q2 2024

Developer/ Owner: Not Listed / Gonzales & Sons Equipment Inc

Data sources: MMG Equity Partners & CoStar

Leave a Reply