Known for its beautiful sandy beaches, tasty cuisines, diverse culture, and favorable climate, Miami has earned its rightful place as one of the best tourist destinations in the world; however, this sparkling seaside city is more than a hub for tourists.

Miami has become a leading investment destination thanks to its growing economy, favorable tax climate, investment-friendly laws, and rising real estate prices. PWC’s 2023 Emerging Real Estate Trends report ranked Miami as the 7th leading real estate market in the country.

The Magic City, AKA Miami, is bursting with opportunities for investors, particularly those interested in multifamily real estate.

Big-name corporations and startups are flocking into Florida, particularly Miami, drawing international attention to this growing city. In this guide, we’ll discuss the reasons to invest in Miami multifamily real estate. But first, a quick primer on multifamily homes and why you should consider investing in one.

What Is Multifamily Real Estate?

A multifamily home, also known as a multi-dwelling unit or MDU is a residential property containing more than one unit.

A townhome, duplex, or apartment complex is a good example of multifamily real estate. If the property owner lives in one of the units, it’s considered an owner-occupied property. Let’s go over the various types of multifamily housing units.

Townhouse

A townhouse is generally a single-family home that shares walls with adjacent homes. Basically, two families live on the same property but are separated by an interior wall. Both families purchase the units separately and have separate entrances.

Duplex

A duplex is a two-story building with different families living on each floor. They typically share a one-floor door, but both units have separate entrances.

Apartment Complex

An apartment complex is a building divided into apartments. It’s simply a single structure consisting of five or more housing units. In an apartment complex, tenants often share resources like a garage, playground, gym, swimming pool, and more.

Semi-Detached House

Similar to a townhouse, a semi-detached home is a single-family home sharing a common wall or walls with adjacent houses. Unlike townhomes that share multiple walls with neighboring houses, semi-detached homes only share one wall or a small portion of the wall.

Benefits of Investing in Multifamily Real Estate

Investing in multifamily properties offers many benefits, including:

1. Steady Cash Flow

Rental properties provide steady cash flow as rent is collected every month.

Unlike the unpredictable stock where dividends aren’t guaranteed, a townhouse or apartment complex will provide consistent cash flow throughout the year. Depending on the location, you can expect an average of 7 – 20% ROI.

2. Steady Rent Demand

Miami is a highly desirable location for residents, attracting a diverse mix of people from young professionals to retirees. The city’s strong job market, world-class educational institutions, and tourism industry create a consistent demand for rental housing. Multifamily properties, such as apartment buildings or condominiums, provide an excellent opportunity to tap into this demand and generate a steady stream of rental income.

3. Tax Benefits

Multifamily properties offer a number of tax benefits to investors, including deductions for depreciation, property taxes, and mortgage interest. These benefits can help reduce your tax burden and increase your average ROI.

4. Appreciation

Another advantage of investing in multifamily real estate is the potential for property appreciation. As the demand for multifamily properties continues to grow, the value of your duplex or apartment can rise over time, providing you with an opportunity to earn a significant return on investment.

Miami’s real estate market has a history of strong price appreciation, offering investors the potential for significant capital gains over time. As demand continues to grow, the value of multifamily properties in prime locations is likely to appreciate, providing investors with an opportunity to build long-term wealth.

5. Diversification and Risk Mitigation

Multifamily real estate investments offer inherent diversification benefits. By owning multiple units within a single property, investors spread their risk across multiple tenants, reducing the impact of vacancy or non-payment of rent by a single tenant. This diversification helps mitigate risk and provides a more stable income stream compared to investing in single-family properties.

Reasons to Invest in Miami Multifamily Real Estate

Now that you understand what a multifamily property is and its importance, why should you choose Miami as your investment destination?

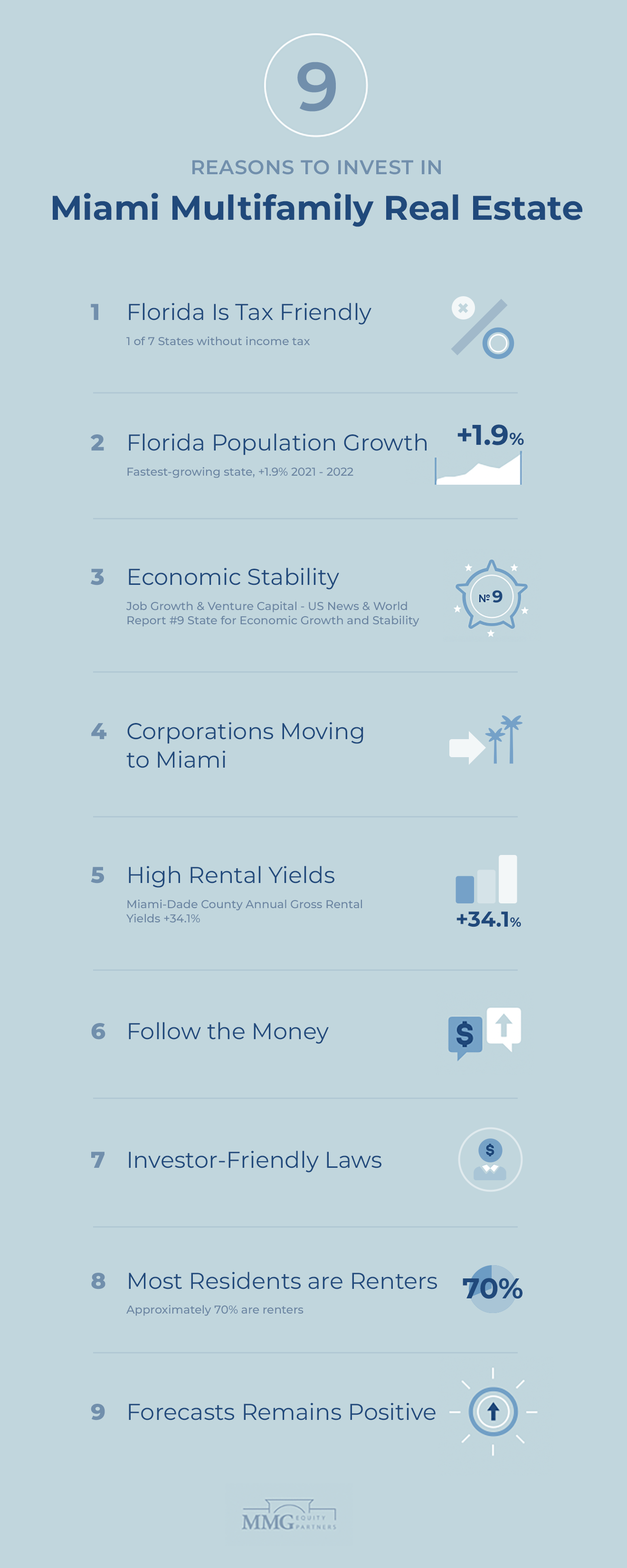

1. Florida Is Tax Friendly

Florida is one of the only seven states that don’t levy income tax.

That means more money in your pocket from your investment if you invest in multifamily properties in Miami. This is a huge benefit, especially if you’re coming from a state with high-income tax, such as New York, California, New Jersey, or Oregon.

Even better, Miami requires no capital gains tax, no state taxes, and no estate tax. And property taxes rank below the national average.

The low mortgage rates in Miami also help to bring mortgage rates down, allowing investors to pay less for multifamily real estate. So, if taxes are one of your top concerns when buying property, you’ll be glad to know that Florida is a very tax-friendly state.

2. Florida Population Growth

After decades of rapid population increase, Florida is now the fastest-growing state in the US, according to the Central Bureau Vintage 2022 report.

From 2010 to 2020, Florida’s population grew by a staggering 14.6%–double the average population growth rate in the US. This exponential growth continued until 2022. Industry reports show that the Sunshine State’s population grew by 1.9% between 2021 and 2022, surpassing Idaho, the previous year’s fastest-growing state.

Some of the reasons for the increasing population in Florida include.

· Low taxes

· Favorable climate all year round

· Beautiful white sand beaches

· Flexibility in living situations as more companies offer remote work

In Miami, the population has increased by a staggering 19.7% since 2010, while the annual growth rate is around 1.09%. The rising population increases demand for multifamily properties, so you can expect the occupancy rate to be high.

3. Economic Stability

When it comes to economic growth and stability, Florida was ranked #9 in the US News and World Report. The Sunshine State’s economy is booming due to a number of reasons.

Job Growth

According to the US Bureau of Labor Statistics, Florida clocked a job growth rate of 1.9% year on year through 2021, ranking #3 in the country, trailing only Idaho and Utah in job growth.

Between March 2022 and March 2023, Florida’s private sector employment grew by 389,000 jobs, reflecting a job growth rate almost three times the national average. Contributing factors to this growth include the ongoing development projects in the region.

Venture Capital

In 2020 alone, Greater Miami saw nearly $2 billion in funding for companies. Biscayne Times called it the new “tech haven,” registering a 45% increase in tech jobs.

According to the National Venture Capital Association (NVCA), Florida’s venture capital industry has immensely grown over the years, with over $5 billion invested in 2023. Venture capital investment accounted for $17 per $1,000 of Florida’s GDP, which is roughly 2.5 times higher than the national average of $6.8 per $1,000 of GDP.

4. Corporations Moving to Miami

Many states are currently experiencing growth and falling jobless rates, but Miami’s declining unemployment and growing population in 2023 aren’t “business as usual.”

Part of this is due to the high number of corporations moving to this Magic City, bringing employees with them. Countless companies have relocated to Miami since 2020, including Blackstone, Swag Up, and Founders Fund.

In February 2023, Silicon Valley tech company LeverX moved its global headquarters to Miami, global banking giant Rothschild & Co opened a branch in Miami, and local IT company Kaseya announced a 3,400-job expansion. On average, fifty-seven companies either relocated or expanded their operations in Miami-Dade in 2022.

The same trend will continue in 2023. So far, 16 companies have announced their plans to relocate to Miami, with the potential to create over 4,000 jobs.

These companies are bringing their employees to Miami and hiring new ones, creating more demand for multifamily housing in the region. Investors should consider this trend when looking for states with the best investment opportunities.

5. High Rental Yields

Compared to other rapidly growing cities and existing cultural hubs in the US, Florida offers comparatively higher rental yields.

Florida is experiencing a trifecta of population growth, low unemployment, and economic growth. All these factors make Miami a top destination for tourists and investors alike. Those with rental properties, in particular, are enjoying high rental yields.

Atom’s 2023 report that analyzed single-family rental returns in 212 US countries ranked Florida among the best states for rental property investors. According to Atom’s report, Florida counties with top increases in annual gross rental yields are:

· Orange County – up 42.7%

· Miami-Dade County – up 34.1%

· Broward County – Up 32%

· Santa Clara County – up 30.1%

· Palm Beach County – up 29.5%

With rental yields on the rise in Miami, rents are increasing faster than home prices, making investing in multifamily real estate more profitable.

6. Follow the Money

As an investor and business owner, one of the best decisions you can make is to invest in regions with growth potential. You can deduce this simply by looking at the kind of business and economic activities in the region.

South Florida, in particular, has become a magnet for financial services firms that are moving some or all of their operations to this region.

Companies such as Citadel have moved their headquarters to Miami, bringing in a wave of resources and clientele. These organizations have positioned Miami as a hub for financial resources for businesses and personal loans.

The proliferation of financial services firms in Miami drives competition, leading to lower loan rates and better services. This benefits multifamily real estate investors in many ways, including access to affordable financing.

Favorable Market Conditions:

Miami’s real estate market has seen steady growth over the years, and the outlook remains positive. The city continues to experience population growth, both from domestic and international migration, which contributes to increased housing demand. Additionally, Miami’s limited land availability and strict zoning regulations make it challenging to develop new multifamily properties, further driving up the value of existing ones.

7. Investor-Friendly Laws

Every state has specific rules governing landlord-tenant relationships. Of all the 50 states, Florida happens to have some of the friendliest landlord-tenant laws.

What does this mean?

Well, landlords in Florida, Miami included, have more freedom and power regarding their multifamily properties and tenants. Miami, for instance, offers plenty of freedom to investors through applicable laws regarding critical aspects of their business.

Some of the benefits Miami property owners enjoy include:

· Rent is unregulated

· No limit on the amount of money that can be put down as a security deposit

· Even a three days late payment of rent can result in eviction

· Lease agreement violations can result in 7 days eviction notice

Leveraging Tax Advantages and Financial Incentives:

As a seasoned investor, you are well aware of the importance of optimizing your tax strategy. Miami’s multifamily real estate market offers several tax advantages and financial incentives to further enhance your investment returns. You can leverage deductions for operating expenses, property management fees, mortgage interest, property taxes, and depreciation.

8. Most Residents are Renters

If you’re looking to invest in multifamily real estate, you’ll want a region with a high demand for rentals. And Miami’s population mainly consists of renters.

Approximately 70% of residents in Miami are renters!

But why is everybody renting, not buying? It’s quite simple! The rising housing prices in Miami force many residents to rent rather than buy property. In some regions, like Miami-Fort Lauderdale-West Palm Beach Metro, property prices have increased 27.4% over the past year.

According to Zillow, the average home price in Miami was $549,154 in 2022, nearly 50% higher than the national average. The Zillow Home Value Index puts the national average at $354,649.

Secondly, most people in Miami are there for seasonal jobs. Over one hundred thousand people have summer jobs. That’s why they don’t buy but rent apartments in Miami.

9. Forecasts Remains Positive

The stable economy, low unemployment rate, consistent population growth, and steadily increasing tourism provide a positive outlook for Miami.

As more people and corporations relocate to Miami, the demand for multifamily real estate will only grow. Moreover, the rising rental yields and prices mean more income for investors, making Miami a profitable investment destination.

These elements and continued developments and construction projects in the state are positive signs of growth across Miami’s commercial real estate sector.

Final Thoughts

Investing in multifamily real estate is a great way to earn passive income and enjoy steady income and tax benefits.

While many states offer these benefits, Miami pushes the boundary higher, offering investor-friendly laws, high rental yields, and more. If you’re looking for a high return on investment from your rental properties, Miami is assured the best place to invest.

Investors can also enjoy other benefits, including a pleasant year-round climate, white sandy beaches, vibrant culture, and world-class infrastructure.

Leave a Reply