Market Snapshot for Orlando Retail Real Estate

We’ve taken a number of the essential statistics for Orlando retail real estate and broken them down below in our report. The retail real estate report is updated every quarter by our in-house commercial real estate experts. First, it is important to give some context to the reasons why Orlando’s retail is doing well currently. It’s no secret that Florida has experienced a population boom during the last few years thanks to a number of economic and lifestyle factors:

-

It is very tax-friendly compared to most states in the USA.

-

Many retired folk from around the country come to live in Florida.

-

It was one of the more business-friendly states during the pandemic.

-

The United States is witnessing a dramatic shift in population from densely populated stats, such as New York and California to states like Florida and Arizona.

-

It is well known for its consistently good weather.

To further expand upon this population growth in the context of Florida, according to the World Population Review, Florida is #7 nationwide for population growth throughout 2021 with a growth of 1.1% overall. Additionally, The Villages, FL (which is one hour NW of Orlando) was found to be the fastest growing metro area nationwide from 2010 to 2020. Of course, population growth is not the only factor that ties into retail real estate, or commercial real estate as a whole, but it is certainly one of the best indicators of where money is going to be spent.

View our commercial properties in Florida to see what real estate assets are available for lease / sale.

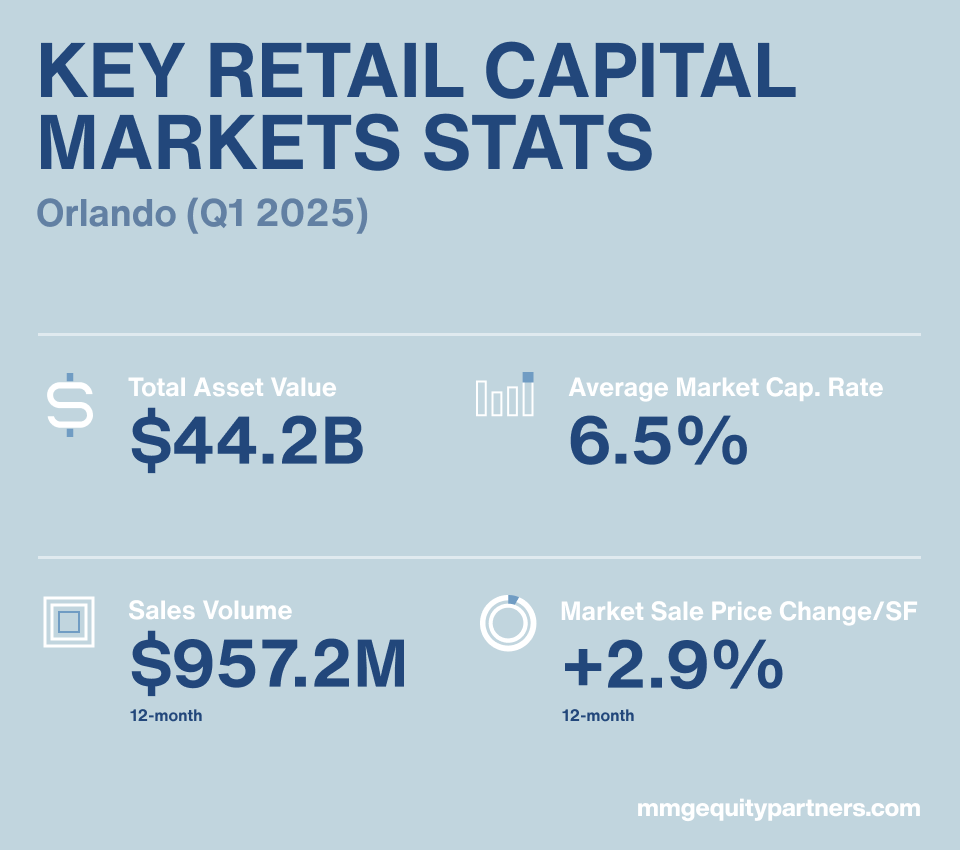

Before we get into the specific statistics for Orlando’s retail real estate market in Q1 2025, let’s give a bird’s eye view for the overall capital market figures to give some context to the region’s retail sector.

Orlando Retail Capital Markets Statistics in Q1 2025

-

Total Asset Value: $44.2B

-

12-Month Sales Volume: $957.2M

-

Average Market Cap Rate: 6.5%

-

12-Month Market Sale Price Change / SF: +2.9%

Orlando Retail Real Estate Sales Volume by Buyer Type & Origin (Past 12 Months)

Below are the buyer types and their origins, i.e.: local, national, or international investors of retail properties in Orlando.

Buyer Type:

-

Private: 64%

-

User: 24%

-

Institutional: 5%

-

REIT / Public: 6%

Buyer Origin:

-

Local: 35%

-

National: 54%

-

Foreign: <1%

Orlando Retail Real Estate Asset Value by Owner Type & Origin (Past 12 Months)

Below are the owner types and the origins of retail property owners in Orlando broken down by their percentage of representation.

Owner Type:

-

Private: 49%

-

User: 26%

-

REIT / Public: 10%

-

Institutional: 13%

-

Private Equity: 2%

Owner Origin:

-

Local: 30%

-

National: 67%

-

Foreign: 3%

Orlando Retail Real Estate Statistics: Leases, Sales, and Projects Under Construction – Q1 2025

A summary of the statistical highlights, latest retail transactions, vacancy / lease trends, and current market activity for Central Florida focusing on Orlando.

Full List of Top Transactions for Q1 2025 Provided Below

KEY RETAIL LEASE STATS: Orlando (Q1 2025)

-

Vacancy: 3.7%

-

Absorption: -360,765

-

Asking rate PSF: $29.77

TOP RETAIL LEASING STATISTICS: Orlando (Past 12 Months)

-

12 Month Deliveries in SF: 795K

-

12 Month Net Absorption in SF: 15.8K

-

Vacancy Rate: 3.7%

-

12 Month Rental Growth: 2.4%

Q1 2025 TOP LEASING TRANSACTIONS: Orlando (Past 12 Months)

- 7524 Dr Phillips Blvd – Tourist Corridor

- Tenant: Crunch Fitness

- Size: 37,080 SF

- Space Type: Shopping Center

- Tenant Rep Co: Crunch

- Leasing Rep Co: JLL

- Plaza On Main – Kissimmee

- Tenant: AutoZone

- Size: 30,810 SF

- Space Type: Shopping Center

- Tenant Rep Co: Atlantic Retail

- Leasing Rep Co: Crossman & Company

- West Colonial Center – West Colonial

- Tenant: AutoZone

- Size: 28,446 SF

- Space Type: Shopping Center

- Tenant Rep Co: Not Listed

- Leasing Rep Co: V 3 Commercial Advisors

- Market Square – Casselberry

- Tenant: Dogtown USA

- Size: 28,063 SF

- Space Type: Shopping Center

- Tenant Rep Co: Not Listed

- Leasing Rep Co: Millenia Partners

- Ocoee Plaza – West Colonial

- Tenant: Not Listed

- Size: 27,000 SF

- Space Type: Shopping Center

- Tenant Rep Co: Not Listed

- Leasing Rep Co: Liberty Universal Mana…

TOP RETAIL SALES STATISTICS: Orlando (Past 12 Months)

Over the course of the past 12 months there have been 490 total retail real estate transactions in Orlando with an average cap rate of 6.3%. The average price per square foot at the time of sale was $301, and the average vacancy was 8.1%.

-

Sales Comparables: 490

-

Average Cap Rate: 6.3%

-

Average Price/ SF: $301

-

Average Vacancy at Sale: 8.1%

TOP RETAIL SALES TRANSACTIONS: Orlando (Q1 2025)

Top Transaction Highlight in Q1 2025: Pura Vida Apartments for $95 Million

- Pura Vida Apartments (3051 W 16th Ave)

- Price: $95,000,000

- Size: 260 Units

- Price/ SF: $365,384

- Year Built: 2022

- Vacancy: 8.9%

- Town Aventura (17900 NE 31st Ct)

- Price: $82,500,000

- Size: 285 Units

- Price/ SF: $289,473

- Year Built: 1991

- Vacancy: 8.4%

- The Upland (445 Hialeah Dr)

- Price: $80,900,000

- Size: 304 Units

- Price/ SF: $266,118

- Year Built: 2022

- Vacancy: 3.0%

- 850 Living (811 NW 43rd Ave)

- Price: $72,500,000

- Size: 230 Units

- Price/ SF: $315.217

- Year Built: 2021

- Vacancy: 3.5%

- 2317 Gunn Hwy

- Price: $14,340,344

- Size: 138,339

- Price/ SF: $104

- Year Built: 2024

- Vacancy: 0%

RETAIL CONSTRUCTION PROJECTS STATISTICS: Orlando (Past 12 Months)

There are currently 43 retail properties under construction in the Orlando market representing 1,310,085 square feet of new product. This represents 0.8% of the total retail real estate inventory and 82.5% of the total space is pre-leased.

Below the stats you’ll find the top-5 largest retail projects currently under development.

-

Properties Currently Under Construction: 43

-

Total Size: 1,310,085

-

Percent of Inventory: 0.8%

-

Pre-leased: 82.5%

RETAIL CONSTRUCTION PROJECTS: Orlando (Past 12 Months)

- Lake Nona West (5955 Lake Nona Blvd)

- Size: 405,100 SF

- Completion Date: Q4 2026

- Developer/ Owner: Lake Nona Land Company, LLC

- Stories: 1

- City Center West Orange (362 Maine St)

- Size: 200,000 SF

- Completion Date: Feb 2026

- Developer/ Owner: City Center West Orange

- Stories: 2

- 10700 Clarcona Ocoee Rd

- Size: 99,590 SF

- Completion Date: May 2025

- Developer/ Owner: Not Listed / Not Listed

- Stories: 1

- The City Center – Retail A (Palm Pkwy & Daryl Carter)

- Size: 94,689 SF

- Completion Date: May 2025

- Developer/ Owner: Unicorp National Developments Inc.

- Stories: 1

- Retail (Schofield Rd)

- Size: 78,000 SF

- Completion Date: May 2025

- Developer/ Owner: Not Listed

- Stories: 3

Data sources: MMG Equity Partners & CoStar

Leave a Reply